spend

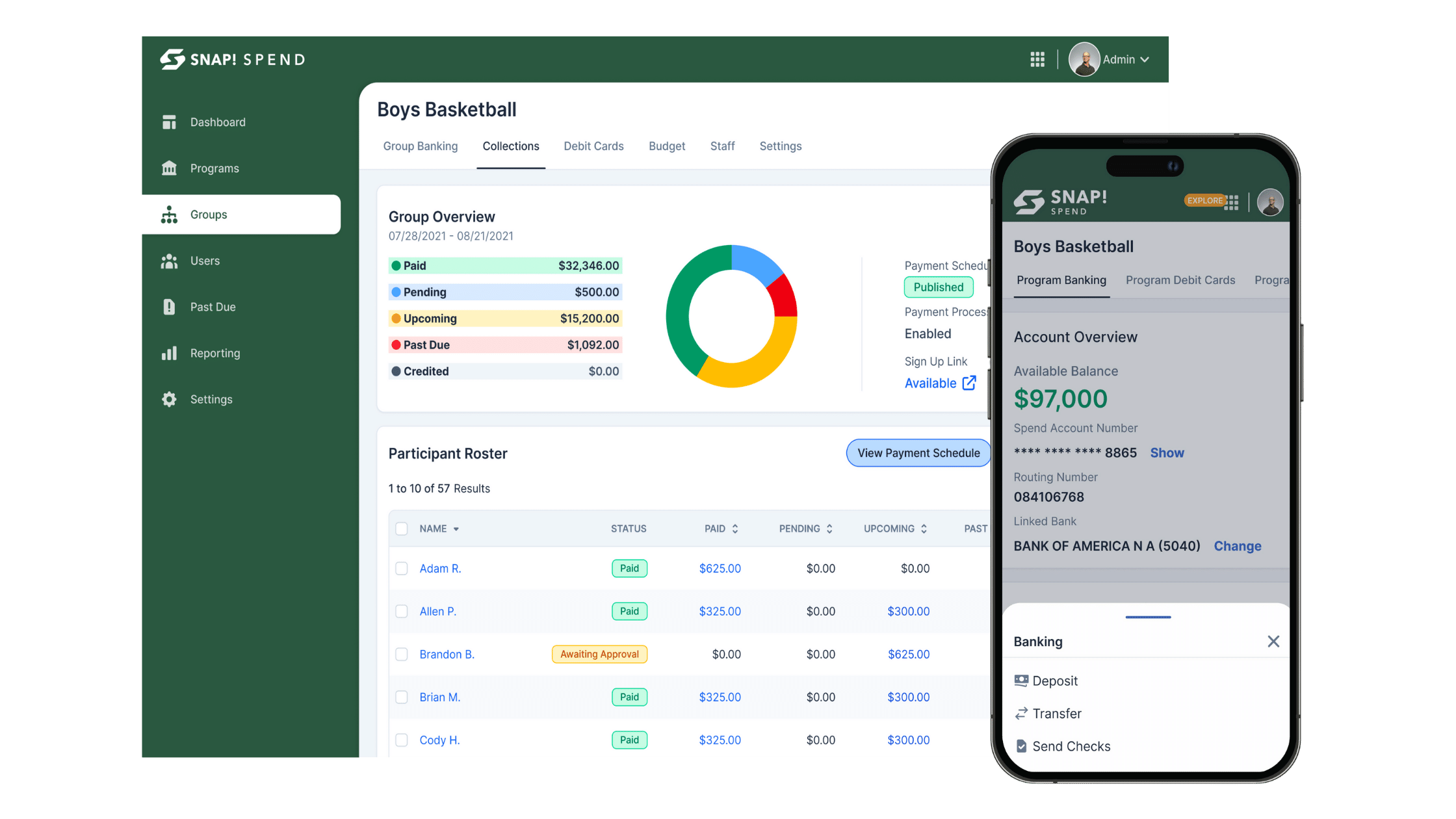

Simplify your program finances with Snap! Spend.

Effortless financial control.

Budget, collect, and spend, all under one roof. Our platform empowers program administrators to create and manage sub-accounts while adding or removing signers digitally. Say goodbye to tedious bank visits, coordination with multiple individuals, and unnecessary paperwork.

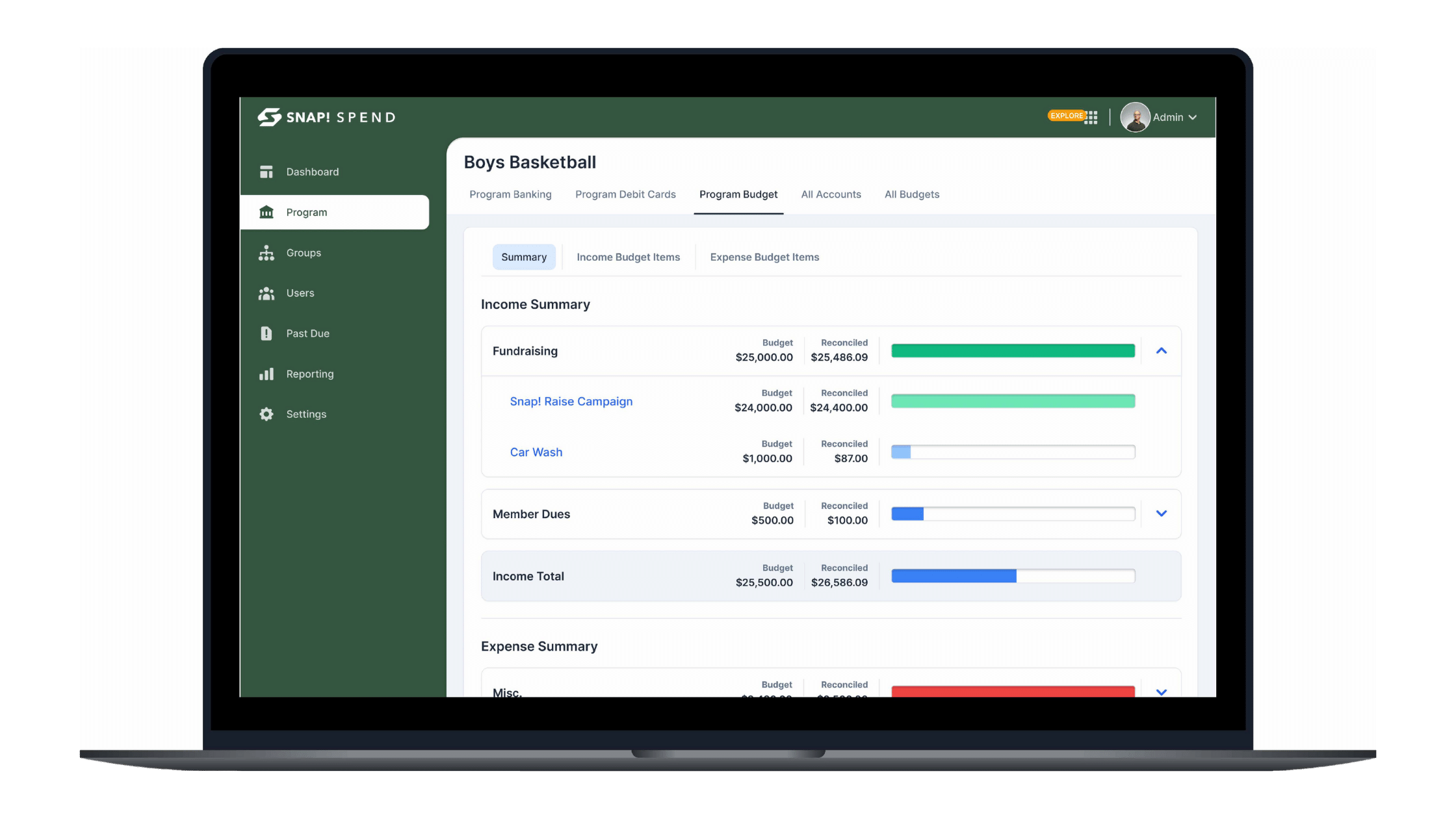

Clear oversight.

With Snap! Spend, group managers effortlessly oversee expenses while retaining full control when needed. Our administrative and observer user settings enable managers to share balance insights without compromising access to the funds.

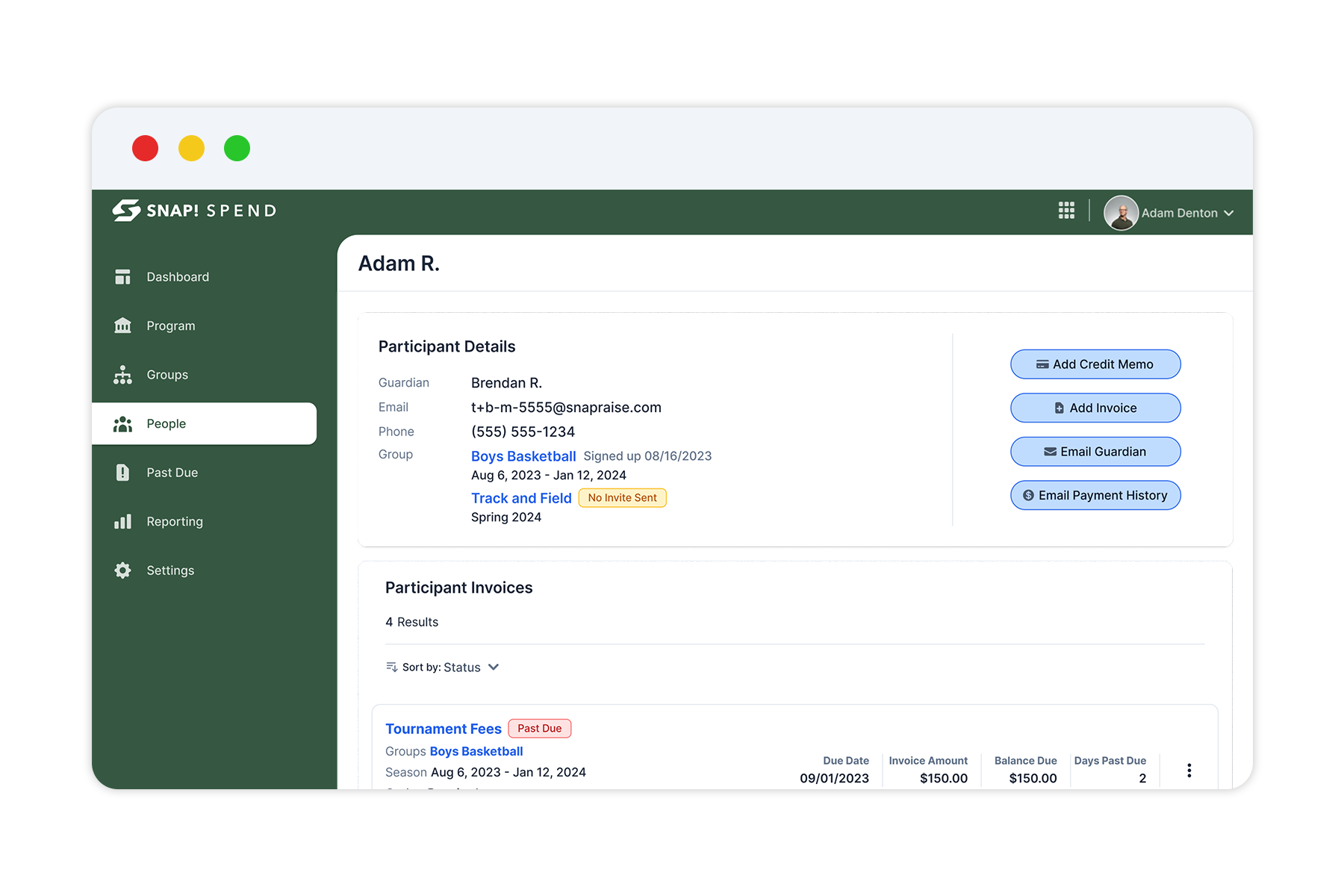

Seamless parent engagement.

Connect with parents effortlessly and request payments without the burden of ACH fees. Snap! Spend makes communication and financial transactions with parents a breeze, ensuring you save both time and money.

Take control of your program’s finances.

Get Started With Snap! SpendKey features:

Snap! Spend is a financial technology company, not an FDIC-insured bank. Banking services provided by Evolve Bank & Trust, Member FDIC.